Remember the “simpler times” in the early days of digital commerce when fraud was mainly associated with stolen credit cards and identity theft? It’s astonishing how much things have changed.

The rise of e-commerce platforms and mobile payment systems, while revolutionising how we transact and interact with businesses, has also presented new opportunities for fraudsters to exploit. Malicious actors embraced the anonymity offered by the digital realm with open arms and began employing more sophisticated social engineering techniques, leveraging psychological manipulation to deceive unsuspecting victims.

The rise of big data and digital footprints has provided a lot of information that can be used for bad purposes. The interconnectedness of personal data allows fraudsters to gather detailed information about their targets and make their fraudulent schemes more precise. They could even mimic legitimate behaviours, evade detection algorithms, and blend seamlessly into the vast digital landscape, much like the chameleons of the cyber realm.

However, businesses don’t have to accept this situation as inevitable. Just like criminals use data to their advantage, organisations can also use it to strengthen their defences. By staying one step ahead of fraudsters and protecting their customers, they can proactively prevent potential damage.

There are a number of compelling benefits that a well-implemented modern fraud prevention strategy empowered by data can offer:

- Enhanced Accuracy and Efficiency: A modern fraud management system can surpass traditional methods in accuracy and efficiency, even amidst overwhelming data. By leveraging advanced algorithms and machine learning, such a system can swiftly analyse vast real-time data sets to accurately identify fraudulent transactions, accounts, and activities as they happen. This optimisation of resources and streamlined operations also significantly reduces costs associated with manual intervention.

- Holistic Risk Assessment: Imagine having a comprehensive understanding of your risk landscape, with access to detailed risk profiles for customers and transactions by consolidating data from a wide variety of sources. This 360-degree view enables accurate risk assessment, tailored mitigation strategies, and customised fraud prevention, allowing businesses to concentrate their resources on high-risk areas for maximum impact.

- Adaptive Fraud Prevention Strategies: The threat landscape is ever-evolving and complex. Counter fraudsters’ agility by continuously analysing new data patterns and staying abreast of emerging techniques. This adaptive approach enables organisations to proactively update prevention strategies, deploy new rules and algorithms, and swiftly respond to emerging risks, ensuring a formidable defence and effective protection of assets.

- Elevate the Customer Experience: Traditional methods can often result in cumbersome and time-consuming identity verification processes that frustrate customers and hinder the overall user experience. Today’s businesses need to strike a delicate balance amidst the data overload, ensuring efficiency and accuracy while minimising false positives and unnecessary customer friction –and that can only be achieved through intelligent data utilisation.

In short, any company that aims to stay ahead must harness the transformative power of data to unlock unparalleled potential in fraud prevention. But how exactly can that be done?

Empowering Customers to See Better

In light of the increasing significance of fraud in financial services, even companies such as Mastercard have recognised the need for enhancing digital identity services to ensure convenience, intelligence, and security. Mastercard has taken steps to offer a more streamlined and secure digital identity verification experience by harnessing the power of the Ekata Identity Engine, which uses sophisticated data science and machine learning while combining two proprietary datasets:

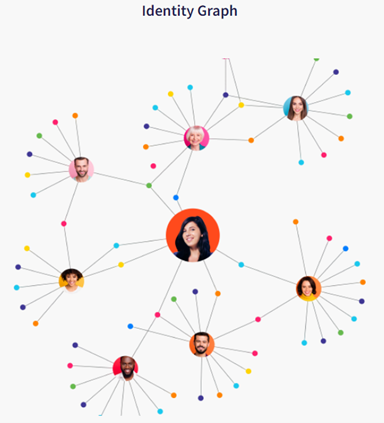

- The Ekata Identity Graph; uses licensed data from authoritative, global providers to create a robust representation of a person’s digital identity, allowing you to connect all the relevant pieces of information about your customers.

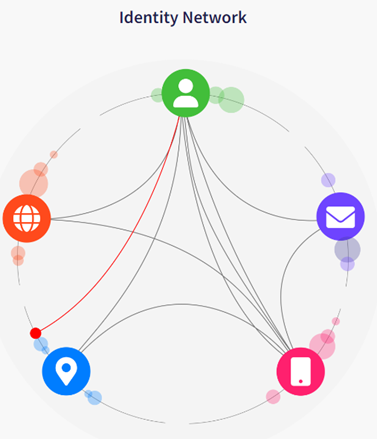

- The Ekata Identity Network; uses data aggregated from more than 200 million monthly anonymised, real-world queries to predict fraudulent versus legitimate interactions by analysing patterns of how identity elements are being used online.

Effectively, the Ekata Identity Engine leverages these two datasets to produce predictive data signals that enable businesses to better understand who their customers are and how their information is being used online. This results in highly effective fraud prevention and detection capabilities, empowering organisations to accurately assess the risk of an identity that is associated with each transaction, account, or interaction – keeping in mind that today’s businesses face the challenge of processing and analysing billions of data elements and connections in order to effectively prevent fraud.

Interested to find out more?

Uncover the remarkable potential of leveraging data to swiftly verify global identities at scale and effectively halt fraud in its tracks. Click the link below to explore how your organisation can harness this power and ensure robust fraud prevention.