Southeast Asia Saw Tech Titans Anchoring Within Its SEAs

Southeast Asia is currently witnessing a surge of interest from giant tech investors like AWS, Google, and Microsoft. These tech titans are making substantial investments to tap into the region’s burgeoning digital landscape and unlock its economic potential.

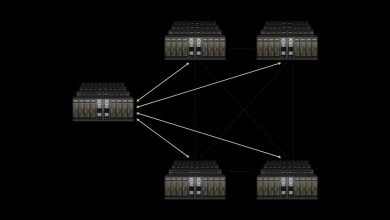

AWS announced a groundbreaking investment of MYR 25.5 billion (USD $6 billion) in Malaysia to establish a new AWS Region, which includes multiple data centres aimed at enhancing cloud infrastructure. This move underscores AWS’s commitment to supporting Malaysia’s digital transformation initiatives and meeting the growing demand for advanced cloud services across Southeast Asia. Similarly, AWS is also investing SG$12 billion (USD $8.8 billion) in Singapore, and another 190 billion baht (USD $5 billion) in Thailand by 2037, further cementing its presence in the region.

Google, not to be outdone, has committed USD $2 billion to create its first data centre and “cloud region” in Malaysia. This investment is set to pave the way for delivering AI-driven solutions, enhancing digital infrastructure, and creating approximately 26,500 jobs. Google’s initiative aligns with the Malaysian government’s vision of leveraging digital technology to bolster economic growth.

Microsoft is also making waves in Southeast Asia with a USD $1.7 billion investment in Indonesia. This funding will expand cloud and AI infrastructure, provide AI skilling opportunities for 840,000 Indonesians, and support the nation’s growing developer community. Microsoft’s investment aims to help Indonesia achieve its Golden Indonesia 2045 Vision, transforming the country into a global economic powerhouse.

These significant investments highlight Southeast Asia’s strategic importance in the tech world. With a young, tech-savvy population of 670 million people and one of the fastest-growing regional economies, Southeast Asia presents a lucrative opportunity for tech giants to expand their influence and drive innovation.

But what really caught the eyes of these investors, wanting to go all-in in this region?

Driving Factors Behind the Investment Surge

Southeast Asia’s digital economy has long captivated the attention of global investors. According to Sandeep Bhargava, Senior Vice President of Global Services and Solutions at Rackspace Technology, who believes that the region’s growth can be attributed to several key factors: “Supportive government policies, high levels of connectivity, a large population, and abundant, cost-competitive land make Southeast Asia an attractive base for data centres, manufacturing, and research and design.”

Southeast Asia’s digital economy has long captivated the attention of global investors. According to Sandeep Bhargava, Senior Vice President of Global Services and Solutions at Rackspace Technology, who believes that the region’s growth can be attributed to several key factors: “Supportive government policies, high levels of connectivity, a large population, and abundant, cost-competitive land make Southeast Asia an attractive base for data centres, manufacturing, and research and design.”

Not to forget, the region’s relatively lower labour costs provide a significant advantage, making it a no-brainer option for tech companies that thrive in making loads of money to scale their operations.

Governments across ASEAN are also pushing for advancements in technology, particularly in hot areas such as Artificial Intelligence (AI), education, and infrastructure, thereby laying a strong foundation for future economic growth.

“But isn’t this region a bit underdeveloped? They must lack the skills to navigate through this advanced technology, right?” a question many may ask.

Sandeep begs to differ. He said, “Southeast Asia boasts a large and skilled workforce with a significant percentage of the young and digitally literate population.” He believes that despite being labelled as a developing region, Southeast Asia is very much tech-savvy and can quickly adopt new technologies, thereby providing an adaptable talent pool for tech companies.

Kumar Mitra, Managing Director and Regional General Manager of CAP & ANZ at Lenovo ISG echoes this sentiment, noting the strategic advantages that are offered by the region’s workforce.

Kumar Mitra, Managing Director and Regional General Manager of CAP & ANZ at Lenovo ISG echoes this sentiment, noting the strategic advantages that are offered by the region’s workforce.

“Tech giants are embracing Southeast Asia’s relatively low-cost yet highly skilled workforce, essential for developing expensive technologies like Large Language Models (LLMs). This combination of cost efficiency and skilled engineering talent is crucial for building advanced technologies,” he explains.

Southeast Asia is shedding its old stereotype, once depicted in films with a faded, sepia-toned brush, and a lack of technological buzz, the region now has undergone a remarkable transformation. Southeast Asia now pulsates with vibrant digital energy, a stark contrast to its past portrayal that makes IT investors willing to invest in the region (with a little help from its relatively cheap labour of course!).

Countries like Singapore, Thailand, Malaysia, and Indonesia also offer unique strategic advantages that attract tech giants in their quest for cloud dominance. With the cloud computing market in Southeast Asia projected to reach “USD $40.32 billion by 2025 as IDC estimates,” quoted Sandeep, plenty of companies are on the move towards the cloud.

This growth is fuelled by the increasing adoption of cloud technologies, which provide local businesses with the agility to adapt to fast changes and respond to competitive pressures. One of the many reasons why organisations in this region are swiftly adapting to the cloud is because, as Sandeep points out, is due to it “empowering anyone with an idea to get their business up and running quickly with minimal up-front costs.”

The region’s rapid cloud growth is evident in Indonesia, the largest digital economy in Southeast Asia, which boasts 167 million active social media users, driving significant data centre demand.

Singapore also stands out with its stable regulatory environment and world-class infrastructure, making it an ideal location for data centre operations. Following the lifting of its moratorium, the government now provides tax breaks and grants for energy-efficient data centres, reducing operational costs and encouraging investment. “Singapore’s reliable power grid, high-speed Internet, and robust fibre optic networks ensure seamless data transmission,” says Sumir Bhatia, President of Asia Pacific at Lenovo ISG, which means that data housed in Singaporean data centres can be accessed and transferred quickly and reliably, minimising latency and downtime. This combination of factors makes Singapore a highly attractive proposition for businesses seeking a secure and efficient location for their cloud-based operations.

Singapore also stands out with its stable regulatory environment and world-class infrastructure, making it an ideal location for data centre operations. Following the lifting of its moratorium, the government now provides tax breaks and grants for energy-efficient data centres, reducing operational costs and encouraging investment. “Singapore’s reliable power grid, high-speed Internet, and robust fibre optic networks ensure seamless data transmission,” says Sumir Bhatia, President of Asia Pacific at Lenovo ISG, which means that data housed in Singaporean data centres can be accessed and transferred quickly and reliably, minimising latency and downtime. This combination of factors makes Singapore a highly attractive proposition for businesses seeking a secure and efficient location for their cloud-based operations.

On the other hand, Thailand and its neighbouring country, Malaysia offer a different type of strategic advantage from the former, through its geographic location, providing access to markets in India and China. Thailand’s incentive program offers tax exemptions, further enhancing its appeal, while Malaysia emphasises digital infrastructure and talent development through initiatives like the Malaysia Digital Economy Blueprint, creating a favourable environment for tech investments.

Challenges and Concerns

The influx of tech investments brings numerous benefits, but it also raises several challenges and concerns. Data privacy and regulatory compliance are primary issues. Sandeep notes that the rising influence of technology companies might draw the attention of regulators, especially concerning data privacy, antitrust, and the ethical usage of AI. “These issues are particularly pertinent in regions where regulatory frameworks are still evolving with the fast development of technology,” he says.

He also points out that the increased adoption of AI technology and rising cyber threats have created a high demand for skilled workers. “Securing and retaining talent remains a hurdle, hindering the growth of tech giants operating in the region,” he explains. A recent Rackspace Technology survey reveals that 85% of respondents in the Asia Pacific and Japan region have attempted to recruit individuals with AI and machine learning skills.

Lenovo ISG’s Kumar also highlights the competitive landscape for talent acquisition. “The presence of tech giants in Southeast Asia intensifies the competition for top talent, especially in fields like software development, machine learning, data analytics, and engineering,” he says. This competition could potentially drive up labour costs and create talent shortages, affecting the region’s overall growth potential.

Broader Impact on Southeast Asia’s Economies

Tech investments in Southeast Asia are driving technological advancements and fostering innovation and entrepreneurship. Local startups and entrepreneurs are empowered by the presence of tech giants, gaining access to advanced technologies and global markets. “Tech giants are pivotal in connecting local businesses to the global market, facilitating exports, and enhancing regional trade opportunities,” says Sumir.

Governments in the region are promoting AI and digitalisation through business-friendly regulations, tax incentives, and infrastructure support, creating a conducive environment for tech companies to thrive. Malaysia’s Digital Economy Blueprint, for instance, emphasises digital infrastructure and talent development, while Indonesia’s large population and growing digital economy present substantial market opportunities for cloud service providers.

Investments are also contributing to sustainable initiatives in the region. Kumar notes, “Lower power costs and increasing renewable energy availability in markets like Indonesia and Malaysia further enhance the region’s attractiveness.” This is particularly relevant for AI applications that require high power density, making Southeast Asia an appealing destination for data centres.

A Vision for 2024 and Beyond

Looking ahead, the future of tech investments in Southeast Asia appears pretty bright. The region’s strategic advantages, coupled with supportive government policies and a skilled workforce, position it as a key player in the global digital economy. Addressing challenges related to data privacy, regulatory compliance, and talent acquisition is essential to sustain this growth.

However, Sandeep points out that the continuous evolution of regulatory frameworks is necessary to keep pace with the rapid development of technology. “Staying at the forefront of advancements, tech giants can improve their capabilities and foster a robust digital ecosystem,” he says. This ongoing evolution is essential for continuous improvement and resilience in technology infrastructure.

Sustainability and renewable energy will also play a crucial role in shaping the future of tech investments in the region. Companies that prioritise sustainable practices and invest in green technologies will not only contribute to environmental conservation but also gain a competitive edge in the market.

More Than Just About Money

The influx of tech giants like AWS, Google, and Microsoft into Southeast Asia signifies more than just economic opportunity; it reflects a deep recognition of the region’s potential to be a global tech powerhouse. The convergence of a young, digitally literate population, supportive government policies, and strategic geographic advantages makes Southeast Asia an irresistible prospect for these companies.

As these investments unfold, they promise to reshape the regional landscape, fostering innovation, creating jobs, and driving sustainable growth. This wave of tech investment is not merely about capitalising on lower costs (I guess?) but about nurturing a vibrant ecosystem that could set new standards in the global digital economy. The enthusiasm of these tech giants underscores a belief in Southeast Asia’s promise, hinting at a future where the region stands at the forefront of technological advancement and economic development.