New IDC Study: Shared Cloud Infrastructure Tops Q2 Infra Spending Thanks to AI

Shared Cloud Spending Is on a Meteoric Rise and Will Keep Soaring

According to the International Data Corporation (IDC) Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on shared cloud infrastructure, including dedicated and shared IT environments, increased 61.5% year over year in the second quarter of 2024 (2Q24) to USD $42.9 billion.

Spending on cloud infrastructure continues to outgrow the non-cloud segment with the latter growing by 41.4% in 2Q24 to USD $19.4 billion. The cloud infrastructure segment experienced lower growth in unit demand at 17.7%, due to a continued increase in average selling prices (ASPs), mostly related to the exponential increase of GPU server shipments.

“Cloud infrastructure spending growth continues to be driven by accelerated Artificial Intelligence (AI)-related investments, which especially impacted servers but also triggered enterprise storage spending,” said Juan Pablo Seminara, Research Director at Worldwide Enterprise Infrastructure Trackers. “Different surveys conducted by IDC in 2024 show how AI investment plans have been scaling up and driving investment priorities for almost every region. Hyperscalers, Digital Service Providers, and major Cloud Service Providers are the ones that keep pushing the growth and that will continue to have a positive impact on the market during 2024 and 2025. And the improved economic prospects will help to extend the positive mood even further.”

Shared Cloud Infrastructure Continues Meteoric Growth

Spending on shared cloud infrastructure reached USD $35.3 billion in the quarter, increasing 74.9% compared to a year ago. The shared cloud infrastructure category continues capturing the largest share of spending compared to dedicated deployments and non-cloud spending, with shared cloud accounting for 56.6% of the total infrastructure spending in 2Q24. The dedicated cloud infrastructure segment presented lower growth of 19.2% year over year in 2Q24 to USD $7.6 billion.

For 2024, IDC is forecasting cloud infrastructure spending to grow 48.8% compared to 2023 to USD USD $164.0 billion. Non-cloud infrastructure is expected to grow 11.7% to USD $67.5 billion. Shared cloud infrastructure is expected to grow 57.9% year over year to USD $131.9 billion for the full year. Spending on dedicated cloud infrastructure is also expected to have double-digit growth in 2024 at 20.4% reaching USD $32.1 billion for the full year. The subdued growth forecast for non-cloud infrastructure at 11.7% in 2024 reflects that even though most of the growth will come from cloud spending, general non-cloud dedicated systems are consolidating their recovery this year.

IDC’s service provider category includes cloud service providers, digital service providers, communications service providers, hyperscalers, and managed service providers. In 2Q24, service providers as a group spent USD $41.8 billion on compute and storage infrastructure, up 64.2% from the prior year. This spending accounted for 67.2% of the total market. Non-service providers (e.g., enterprises, government, etc.) also increased their shared cloud spending to USD $20.5 billion growing 38.2% year over year. IDC expects compute and storage spending by service providers to reach $157.8 billion in 2024, growing at 49.4% year over year.

On a geographic basis, year-over-year spending on cloud infrastructure in 2Q24 showed very positive results across all regions where the fastest growing regions were Asia/Pacific (excluding Japan and China), Japan, USA, and Canada with 110.7%, 98.1%, 72.1%, and 53.8% year-over-year growth, respectively. The other regions also showed very solid yearly increases with Central & Eastern Europe, Western Europe, China, Middle East & Africa, and Latin America growing by 48.7%, 27,7%, 24.8%, 23.4% and 9.7% in that order.

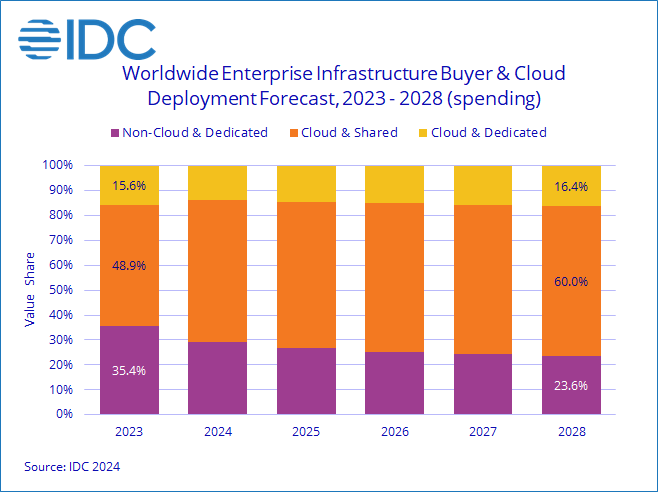

Shared Cloud Infrastructure Spending Will Continue to Grow

Long term, IDC predicts spending on shared cloud infrastructure to have a compound annual growth rate (CAGR) of 18.1% over the 2023–2028 forecast period, reaching USD $253.0 billion in 2028 and accounting for 76.4% of total compute and storage infrastructure spend. Shared cloud infrastructure spending will account for 78.6% of the total cloud spending in 2028, growing at a 18.9% CAGR and reaching USD $198.8 billion. Spending on dedicated cloud infrastructure will grow at a CAGR of 15.3% to USD $54.3 billion. Spending on non-cloud infrastructure will also rebound with a 5.3% CAGR, reaching USD $78.3 billion in 2028. Spending by service providers on compute and storage infrastructure is expected to grow at a 17.1% CAGR, reaching USD $233.0 billion in 2028.

IDC’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment is designed to provide clients with a better understanding of what portion of the compute and storage hardware markets are being deployed in cloud environments. The Tracker breaks out each vendors’ revenue into shared and dedicated cloud environments for historical data and provides a five-year forecast. This Tracker is part of the Worldwide Quarterly Enterprise Infrastructure Tracker, which provides a holistic total addressable market view of the four key enabling infrastructure technologies for the datacenter (servers, external enterprise storage systems, and purpose-built appliances: HCI and PBBA).

Taxonomy Notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service.

Shared cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The shared cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters; these services in total are called public cloud services. The shared cloud market also includes digital services such as media/content distribution, sharing and search, social media, and e-commerce.

Dedicated cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In dedicated cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilisation model, where standardised services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

For more information about IDC’s Quarterly Enterprise Infrastructure Tracker: Buyer & Cloud Deployment, please contact Lidice Fernandez at lfernandez@idc.com.