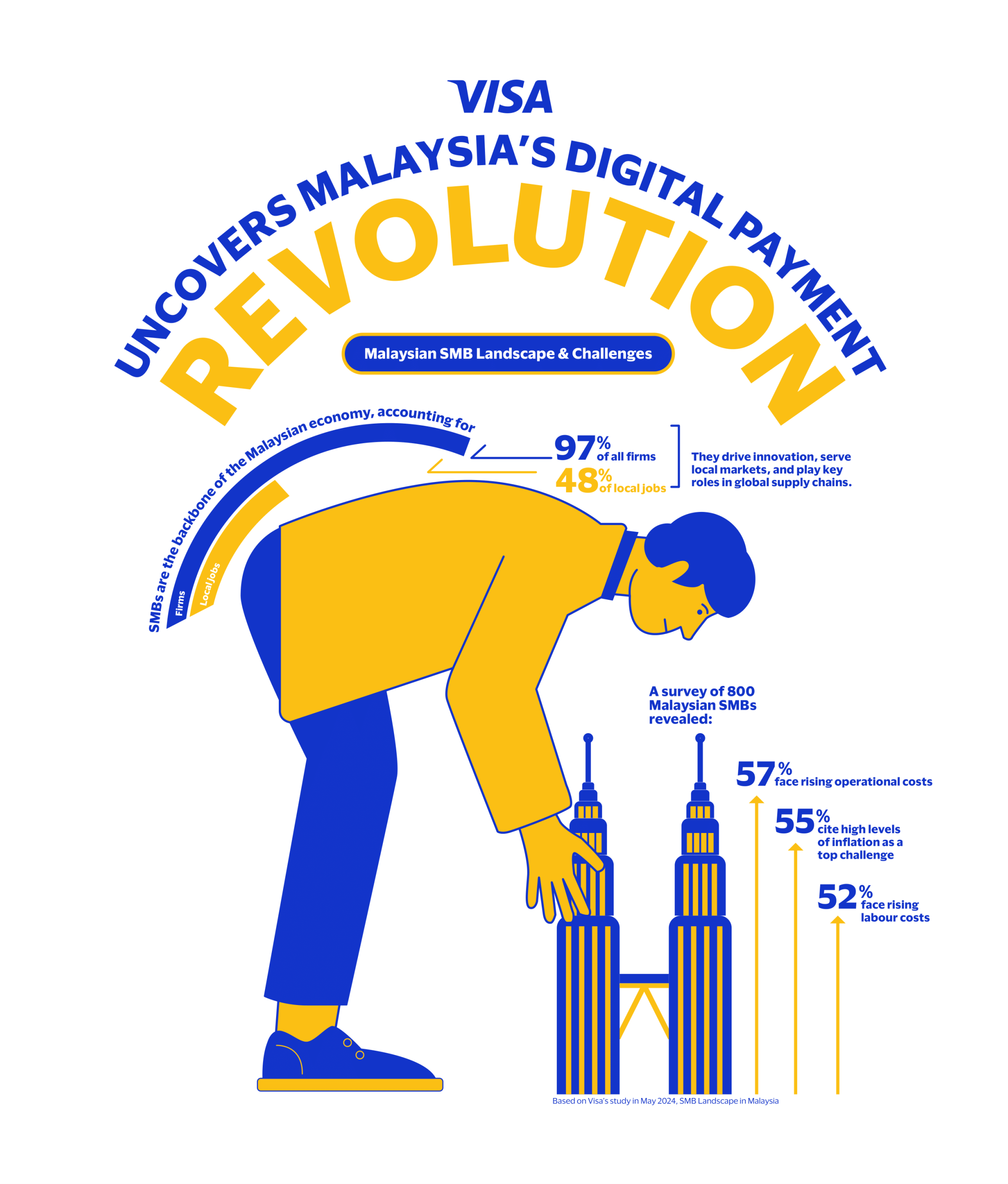

How Malaysian SMEs Are Navigating Challenges and Embracing Digitalisation

Malaysian SMEs Have to Navigate Great Challenges Like Economic and Manpower Constraints

Small and medium-sized enterprises (SME) are the backbone of the Malaysian economy, accounting for 97 per cent of all companies and providing 48 per cent of employment. SMEs are frequently key drivers of innovation, introducing diverse offerings to local markets and playing essential roles in global supply chains.

Amid an evolving landscape, Malaysian SMEs encounter numerous financial, economic, and manpower constraints, as highlighted in the Visa study, ‘Evolving SMB Landscape in Malaysia.’ According to a survey of 800 Malaysian SMEs, the primary challenges shaping business priorities today include rising operational costs (57%), labour expenses (52%), and high levels of inflation (55%).

There are subtle nuances between firms’ priorities depending on their size, type, and industry. For instance, nearly a third of small businesses focus on digitalising their functions and processes, compared to 42% of medium businesses. This disparity reflects smaller firms’ limited resources for digitalisation and medium firms’ relative maturity in this area. In addition, while small firms may lack significant resources to invest in digitalisation, medium-sized firms face higher growth costs and fewer funding avenues.

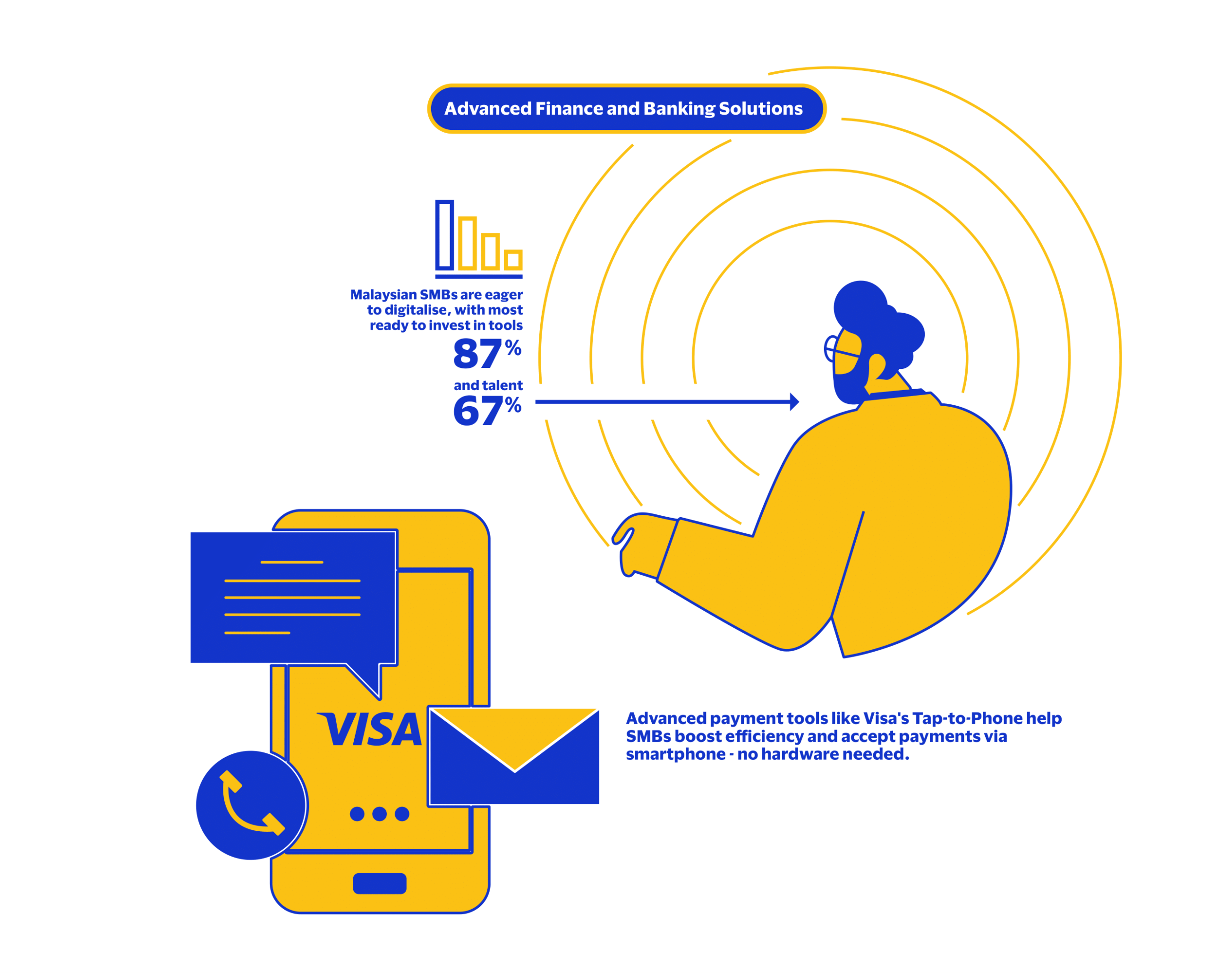

Malaysia SMEs Embrace Digitalisation

Digital technologies have transformed the commercial landscape for SMEs by opening doors to broader local, regional, and global markets and enabling firms to diversify revenue streams without significant cost increases. Inventory management platforms are injecting more transparency into global supply chains and minimising human error in manual processes.

There is potential for new technology such as Artificial Intelligence (AI) and automation solutions to empower SMEs to provide more personalised experiences for customers and further improve productivity levels. A third of Asia Pacific SMEs expect to increase automation and digitalisation investments by 2026.

Digital Payments Revolution for SMEs

Digital payments adoption among SMEs is trending upwards as businesses respond to customers’ demands for seamless, fast and secure cashless transactions. SMEs are increasingly using digital channels to pay suppliers and vendors, presenting growth opportunities for providers as firms digitalise their supply chains.

According to Visa’s study, online payments are Malaysian SMEs’ preferred digital payment method. Direct bank transfers (61 per cent) and digital wallets (46 per cent) follow close behind when it comes to popularity of usage, especially for smaller firms.

These payment methods are especially relevant to Malaysia’s large population of street vendors, many of whom operate in an environment where bank accounts, credit and traditional banking services are scarce. Currently, micro-SMEs are a segment that traditional banks, FinTechs, and digital banks are looking to address to ensure they have access to digital payment services and solutions.

Building Tomorrow’s Success Stories Today with Visa

Visa’s Tap to Phone solution is a low-cost solution that allows micro-SMEs to accept payments using their smartphones, without the need for additional hardware. This solution significantly reduces the barriers to entry for street vendors, enabling them to offer seamless, fast, and secure cashless transactions. By adopting such technologies, street vendors can diversify their revenue streams and improve their overall business operations.

Debit and credit card usage is popular among Malaysian SMEs, with close to half of medium businesses relying on debit cards, while another 42 per cent using corporate credit cards. In the dynamic world of small and medium-sized enterprises (SMEs), managing finances efficiently is crucial for success. One of the key aspects of financial management is the clear separation of personal and business expenses. This distinction not only simplifies accounting but also ensures that business owners can take full advantage of the benefits offered by business-specific financial products.

When SME owners use personal cards for their business expenses, they often find themselves sifting through statements, trying to distinguish between personal and business expenditures. This not only consumes valuable time but also increases the risk of errors and misreporting. Moreover, personal cards do not offer the same level of financial management tools and benefits that business cards do.

Business cards, including debit, prepaid, and credit cards, provide a streamlined solution to this problem. By using business cards exclusively for business transactions, SME owners can maintain a clear and organised record of their expenses. This separation simplifies bookkeeping, making it easier to track and manage their business finances.

Business cards often come with features tailored to the needs of businesses, such as expense tracking, detailed statements, and integration with accounting software. Business credit cards can offer a suite of services that personal cards do not, which include higher credit limits, rewards programmes designed for business spending, and access to business-specific perks such as travel insurance, purchase protection, and discounts on business-related services.

The Journey Towards Digital Transformation

By leveraging these benefits, SMEs can optimise their cash flow and earn rewards on their spending. Having a ready credit product can also benefit companies when there are unplanned investment opportunities.

SMEs’ journeys towards digital transformation represents a strategic imperative in today’s rapidly evolving business landscape. As they navigate this digital frontier, their fundamental focus remains constant: growing business revenues and ensuring sustainable expansion. Digital payment systems serve as powerful catalysts in this growth journey, enabling businesses to significantly enhance operational efficiency, reduce transaction costs, and dramatically accelerate payment cycles.

Moreover, adopting digital payments opens doors to previously untapped customer segments and markets, creating new revenue streams while strengthening relationships with existing clients through improved service experiences. The digital transformation journey will ultimately shift from being a challenging transition to becoming the foundation upon which tomorrow’s business success stories are built.